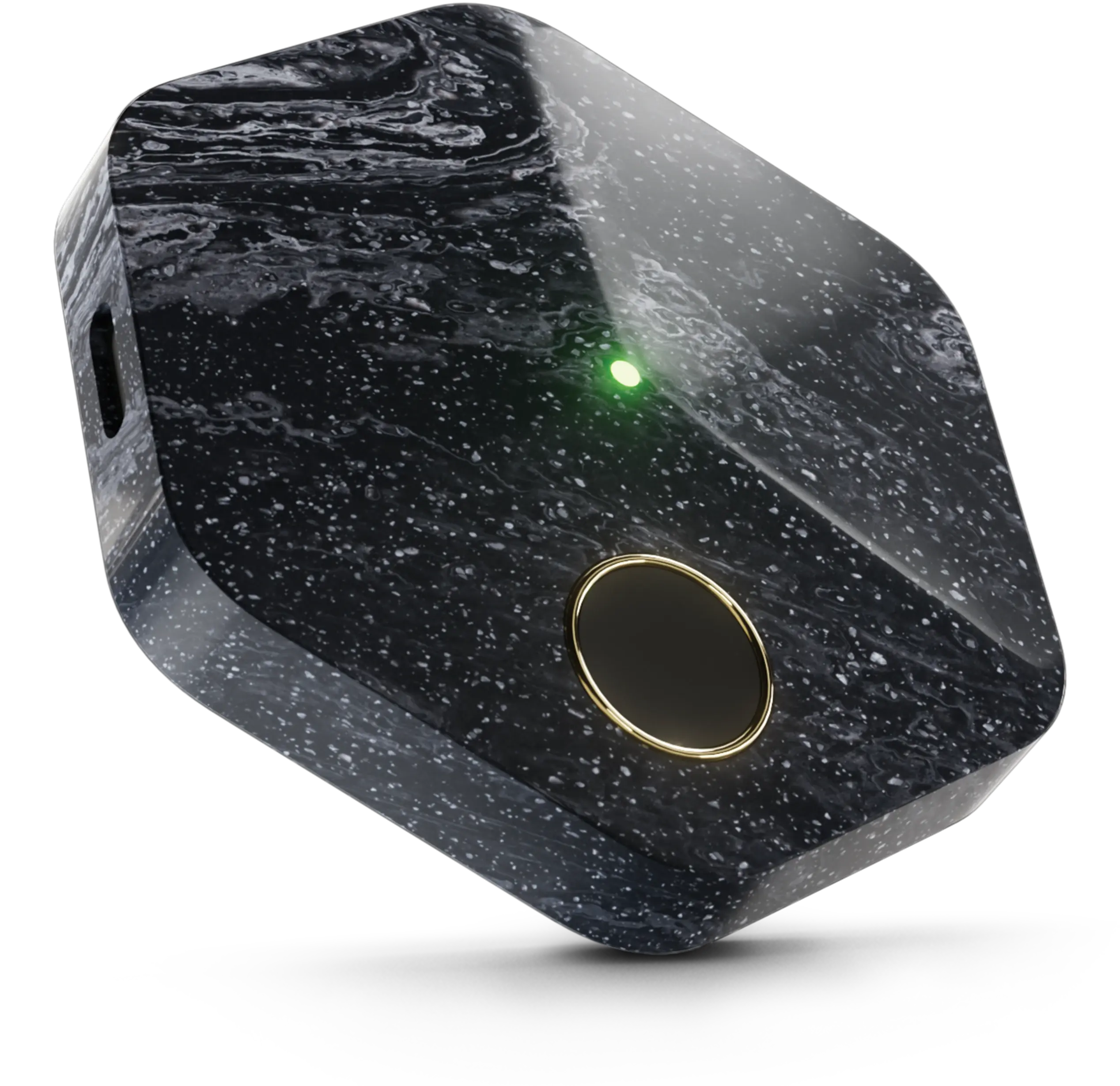

In 2025, securing digital assets is more important than ever, and the D'CENT Biometric Wallet is emerging as one of the most secure and user-friendly hardware wallets on the market. With advanced fingerprint authentication, native support for over 3,800 coins and tokens, and seamless MetaMask integration, this wallet is designed for both security and convenience. In this review, we’ll explore what makes the D'CENT Biometric Wallet a top choice for crypto holders.

Key Features of the D’CENT Biometric Wallet

1. Uncompromising Security with Biometric Authentication

EAL5+ Certified Secure Chip ensures high-level protection against hacking attempts.

Fingerprint Authentication adds an extra layer of security for transactions.

Offline Storage keeps private keys completely offline, reducing exposure to online threats.

2. Native Support for Over 3,800 Coins & Tokens

Supports Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), Solana (SOL), Dogecoin (DOGE), Polygon (MATIC), Polkadot (DOT), and many more.

Compatible with 73 blockchain networks, allowing seamless multi-chain management.

3. Seamless Integration with Web3 & MetaMask

Connects directly with MetaMask for easy access to DeFi apps, staking, swaps, and NFT management.

Supports browser extension wallets for a full Web3 experience.

4. User-Friendly Navigation & Large Display

Four-button navigation makes setting up and managing crypto effortless.

A large screen allows users to view the full private key at once, reducing transaction errors.

5. Long-Lasting Battery & Durable Design

Designed to last for years without performance issues.

Reliable battery ensures cold storage protection for extended periods.

6. No Hassle Updates & Easy Recovery

No need to reinstall wallets after firmware updates.

Recovery through standard BIP39 and BIP44 seed phrases, ensuring simple backup and restoration.

Why Choose the D’CENT Biometric Wallet in 2025?

✔ Enhanced Security – Biometric fingerprint authentication for maximum protection.

✔ Wide Crypto Support – Native compatibility with thousands of digital assets.

✔ Web3 Ready – Easily connect with MetaMask for full DeFi and NFT access.

✔ User-Friendly Design – Intuitive navigation with a large display for smooth transactions.

✔ Reliable & Durable – Long-lasting battery and robust construction ensure years of usage.

Final Verdict

The D'CENT Biometric Wallet is an ideal choice for those looking for a secure and feature-packed hardware wallet in 2025. With its fingerprint authentication, support for thousands of cryptocurrencies, and seamless Web3 integration, it’s one of the most advanced options on the market. Whether you're securing your Bitcoin or diving into DeFi, the D’CENT Biometric Wallet ensures your assets remain safe and easily accessible.

🌊 Seize your crypto future with confidence! 🌊